A survey by the Wisconsin Policy Forum suggests “dark store” tax appeals are on the rise as many local communities plan advisory referendums on the issue this fall.

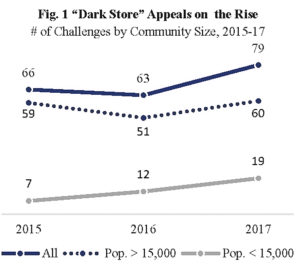

Local officials in 215 Wisconsin communities said they had 79 dark store cases in 2017, up from 63 in 2016 and 66 in 2015.

The trend of dark store tax appeals, in which retailers seek to lower their tax bills through comparisons to vacant (or dark) stores, has been widely reported on by newspapers across Wisconsin.

A USA TODAY NETWORK-Wisconsin analysis in December 2017 found that retailers were trying to cut their tax assessments by more than $700 million across the state.

In an advisory referendum earlier this month, West Allis voters demanded legislators close the so-called dark store loophole. Racine County is considering a similar referendum and the issue will be considered by voters in Rock and Walworth counties on Nov. 6.

A “dark store” lawsuit brought by Lowe’s will cost taxpayers in Oshkosh nearly $130,000.

» Read the Wisconsin Policy Forum report