Recent tax incentive proposals to companies like Foxconn Technology Group and Kimberly-Clark Corp., have renewed a debate in Wisconsin over business tax credits.

In an effort to provide a broader context for the discussion, which has revolved mostly around packages for individual firms, the Wisconsin Policy Forum has released an analysis on the state’s manufacturing industry and its impact.

Over the last four decades, state officials have approved tax incentives that were worth more than $900 million in 2016, according to the report. That number is up from an inflation-adjusted $724.5 million in 2008, while tax advantages and incentives for Wisconsin manufacturers have continued to rise since 2016.

Though statewide employment is projected to grow three and a half times faster than manufacturing from 2016 to 2026, the industry remains a critical part of the Wisconsin economy. Manufacturing provides nearly half a million jobs while paying higher than average wages to workers around the state.

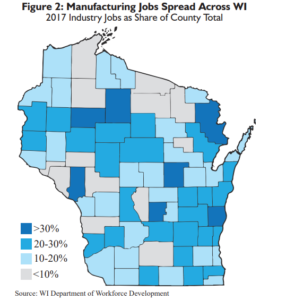

Manufacturers employed 16.4 percent of Wisconsin workers in 2017, nearly twice the national average of 8.6 percent. The industry made up more than 30 percent of jobs in 2017 for seven Wisconsin counties and more than 20 percent in an additional 25 counties.

The average manufacturing job in Wisconsin paid $56,980 in 2017, compared to the state’s average annual wage of $47,250 for all workers.