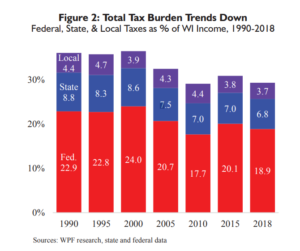

Wisconsin’s state tax burden reached a nearly 50-year low in 2018, with state and local taxes accounting for 10.5 percent of taxpayers’ personal income, according to a new Wisconsin Policy Forum report.

While the low tax burden is good for taxpayers, it may also be one reason why state and local officials increasingly are being forced to consider new revenue sources, such as wheel, sales and room taxes. Collections of these taxes have increased significantly in recent years, but remain a small portion of the overall tax burden.

With a strong economy and personal income growth, the state’s tax burden could continue to fall, even with increased taxes. But if tax increases combine with a slowdown in economic growth, the burden could rise.

» Read more